What Is Compound Interest And How To Calculate It? The Compound Interest Formula

What compound interest is

Compound interest is the foundation of investing. It’s even more important, the whole financial system in our world is based on compound interest. It’s everywhere, and this is why it’s so important to understand exactly what compounding is. Here I will talk about the most commonly used compounding interest formulas in our everyday life and this way I will show you how the 8th miracle of the world works.

Everybody knows what interest is. If you have $100 and put it in a bank account for a year at 5%, at the end of the year you get:

5% x $100 = 0.05 * $100 = $5 profit. You have $105 at the end of year 1.

But what about compound interest? It doesn’t come into play in this situation. It’s activated if you decide to leave your profit ($5) in the bank and wait another year. You start the second year with $105 and at its end, you will have again a 5% profit.

5% x $105 = 0.05 * $105 = $5.25 profit. You have $105 + $5.25 = $110.25 at the end of year 2.

This is where compound interest turns on, compare your profits after each of the two years. In the second year, you get $0.25 more profit than the first one and this is why you get interest on your interest of $5 from the first year. This is what compound interest actually is. It’s magical because your profit gets bigger and bigger every next year without the need to add anything to your initial investment. In compounding, the interest after each year is capitalized, becomes an addition to the initial investment, and starts earning interest itself.

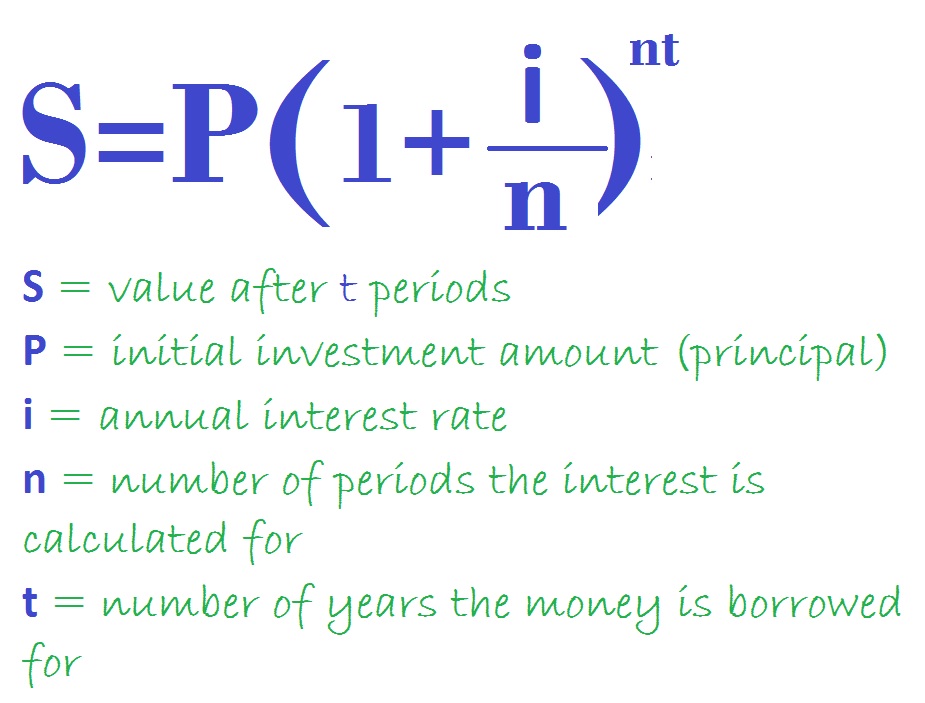

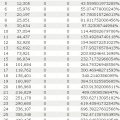

If we continue the example if you leave your investment in the bank one more year (third), your profit will be $110.25 * 5% = $5.5125 and you will have 115.76 in total. It increases again and the best thing is that you do nothing about this, you just wait for another year. After the 4th year, your profit will be $5.79, and so on, and so on. Every next year your profit increases more, and more, and more. In the following table, you can see how your investment would grow if you waited for 20 years. The results are amazing, after this period of time your initial investment of $100 would become $265.33 and you would have realized 165.33 % total ROI (Return On Investment). This is cool, isn’t it? If you would like to make your own calculations with different percentages and amounts, you can try our nice compound investment growth calculator here. You can use it to plan the growth of your savings and make some more complicated compounding calculations.

The Real Power of Compounding

But this is not all… Here I will show you what the real power of compounding is… So, we went through the example from above, where we invest $ 100, for 20 years at a 5% interest rate. Let’s change the example a little… Let’s say we want to invest $100 for 20 years again, but this time we can invest it at 10% interest. We are just changing the interest rate. So, what our amount would be after 20 years? At 5% it goes to $265, as we saw above. Now we double the rate, will the amount double? What do you think? The answer is NO. The amount will more than double and reach $672.75 with a total ROI of 572 %. So, this is the real power of compounding:

if you double the interest rate, your ROI more than doubles if everything stays equal

Using again the same example, if you double one more time and make the 10% rate 20%. Your $100 buck would grow to the astonishing amount of $3,833.76 In the table below you can see the three examples together. Just see what you would have after 20 years if you invest just $100, but at a 40% interest rate: This is the real power of compounding, I think I explained it well and now you got it. So, the most important thing when you invest is to get the maximum interest rate you can. Even a small difference can make a big impact over time, in the long run. This is also true when you take a loan. Even half of a percent can change the big time the total amount you need to pay for your mortgage loan, just because it is for a long period of time, usually 20-30 years. So, be careful.

| Interest Rate |

Initial Investment |

After 20 years in $ |

Total ROI% |

| 5% | $100 | $265.33 | 165.33% |

| 10% | $100 | $672.75 | 572% |

| 20% | $100 | $3 833.76 | 3733.76% |

| 40% | $100 | $83 668.26 | 83,568.26% |

The power of compounding interest

Compounding is an ancient financial concept that has been around for centuries. It is the process of reinvesting the returns generated by an asset to grow over time. Compounding has been used for hundreds of years as an effective wealth-building strategy and is one of the oldest and most effective ways to generate wealth.

Compounding works by reinvesting the returns generated from an asset into the same asset over time. This, in turn, can generate larger returns than would be generated simply through the investment of capital in a single lump sum. As such, compounding is a method of generating wealth on a long-term basis, allowing returns to accumulate over time.

One advantage of compounding is that the returns generated can compound indefinitely. This means that, if left untouched, the returns generated over time can grow exponentially and become quite sizable over a long period of time. This process is known as the power of compounding and can yield impressive returns over extended periods of time.,

Overall, compounding is an effective long-term wealth-building strategy that can generate impressive returns given a steady rate of return over a long-term basis. While there are risks associated with compounding, it can still be a worthwhile strategy if done cautiously. It is important to note, however, that compounding is not a get-rich-quick scheme and will require patience and discipline to yield its rewards.

If you like this post, please, consider sharing it with friends. Also, you can get some investment ideas by visiting our investment strategies section of the site.