How To Incorporate A Business In The USA? Pros And Cons Of Different Legal Forms

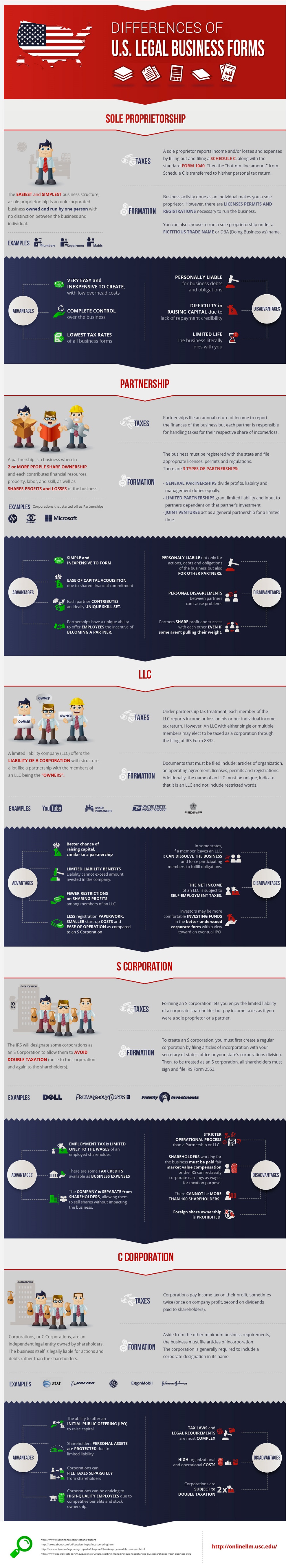

In the life of an entrepreneur, one day comes the moment for incorporating his/her activities. And then usually comes the question ‘How the heck do I do that?’ or ‘How to incorporate a business?’. What type of company would you use if you needed to do that? Would you form a C Corp or you would choose a sole proprietorship? Maybe founding a limited liabilities company (LLC)? What are the differences between all of these what would be the most appropriate for you? Someone may say: Damn, isn’t it enough that more than 90% of starting entrepreneurs fail, but now I should do some legal and accounting stuff? I am not trying to scare you, but the problems just start with founding your company. Everyone who wants to be an entrepreneur should learn to cope with things, no matter what he/she comes across, so be prepared. Now, again on the matter… If you are not quite familiar with the pros and cons of the different legal forms of businesses, we have prepared a cool infographic for you. In fact, we just came across this picture, it was created by some guys/gals from the University of Southern California. This means that this information is quite reliable and we hope it helps you a lot in choosing the right legal form of business for you. The different variants are compared in two major aspects – taxes and formation. Depending on who you are, what you do, and how, this picture will help you make the right choice. See yourself below:

How To Incorporate In USA? Choosing Between Sole Proprietorship, Partnership, S Corporation, C Corporation, or LLC

How to incorporate your business

How to incorporate your business

More about the most common legal forms of business in the USA

For those looking to form a business, there are a variety of legal business forms from which to choose. Each structure has its own advantages, disadvantages, and legal implications, and must be carefully considered before deciding which one is best for a particular business.

Sole Proprietorship

A sole proprietorship is the simplest and most common form of business. In a sole proprietorship, all profits, losses, and liabilities are under the name of the sole proprietor. This structure is advantageous in that all profits pass directly to the individual and financially, is easy to manage as most legal formalities are minimal. However, in a sole proprietorship, the individual owner is responsible for his or her business debts, taxes and liabilities, meaning they are at risk of personal assets being used to pay for damages or debts gained from the business.

General Partnership

In a general partnership, two or more people agree to share in the profits and losses of a business. Each partner is personally responsible for any liabilities incurred in the business. This structure is an attractive option for those starting out as it costs very little to form and is easy to manage, though all partners are responsible for any business debt, meaning any partner can be liable for damages or debts gained by the business.

Limited Liability Company (LLC)

The limited liability company (LLC) is one of the most popular legal business forms. An LLC is a business structure that separates the owners and the business, meaning the owners are not personally liable for business debts or liabilities. LLC members are responsible only for the money they have invested in the LLC. The LLC structure has the flexibility of a sole proprietorship or general partnership as well as certain tax and legal benefits.

Corporations

A corporation is a legal business structure for larger businesses and those that require more complicated legal and tax arrangements. A corporation is a separate legal entity from its owners and is the most complex of all business forms. A corporation is owned by shareholders who elect a board of directors, who in turn manage the company. Corporations enjoy more liability protection than other business forms, as shareholders are not personally liable for the actions of the corporation. They also offer various tax benefits and are sometimes preferred for larger business operations.

In summary, the variety of legal business forms in the USA offers entrepreneurs a range of opportunities to structure their businesses the way they’d like to. Knowing the advantages, disadvantages and legal implications of each form is essential to make the right decision when forming a business.

Did this post proved any help in choosing the most suitable type of organization? Tell us about it, we would like to improve your experience on the site.

Don’t forget to share this post, if you think it’s helpful. This way you will help us write more cool articles like this. Thanks!