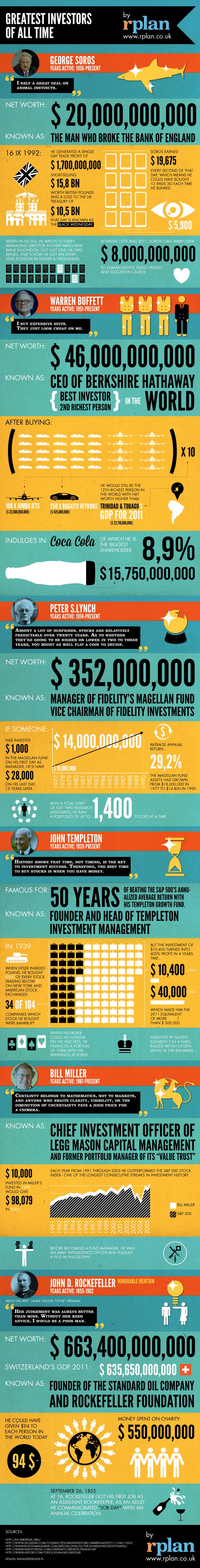

Who Are The Greatest Investors Of All Times – Infographic

Investing is a cool way to make so much money, that even your wife won’t be able to spend for a lifetime. However, it’s not that easy to be a successful investor, those who made it really big are only a few and a great way to enhance your chances of catching up with them is to learn from their experience. The Internet is full of information about the greatest investors of all time. You can find some cool articles on the matter on this site, by checking our famous investors’ stories section of the site. In this post, you can enjoy a nice infographic about some of the biggest names in the field. You can read some curious facts about them, how they made their wealth and what each of them is famous with. Here are the short stories of Bill Miller, George Soros, Warren Buffett, Peter Lynch, John Templeton, Bill Miller, and last but not the least -John Rockefeller.

Some Of The Greatest Gurus In Investing

Investing is one of the great life–changing strategies to secure your financial future. While it can often be challenging, the rewards for becoming a successful investor are tremendous. If you want to become a great investor, here are a few things to keep in mind in order to pave your path toward success.

Some basic tips for starting investors

1. Understand the risks involved: Investing isn‘t without risk, and you should be aware of this. You can lose money on any investment, so you should consider the chances of that happening and make sure you are comfortable taking on this risk when investing your hard–earned money.

2. Diversify: Diversification is key in investing, as it helps you spread out your risks and make for a more efficient portfolio. Rather than putting all of your eggs in one basket and focusing on just one stock or one type of security, it‘s important to invest in a variety of different assets that offer different returns and involve different risks.

3. Utilize research: Research is an essential part of investing, as it allows you to gain a deeper understanding of the markets, the securities you‘re investing in, and the potential risks and rewards. By understanding the underlying market dynamics, you can make decisions about what investments are right for you and your risk tolerance.

4. Remain disciplined: Investing is an emotional experience, and as an investor, you can quickly make decisions based on fear or greed. However, it‘s important to remain disciplined and stick to your investment plan. When making investments, focus on the facts rather than letting your emotions take control.

5. Monitor your investments: Once you‘ve chosen your investments, you should regularly monitor them to ensure they‘re performing as expected and to reassess the risks. If any of the risks change, it‘s important to adjust your style of investing or the portfolio allocations to remain consistent with your investment goals.

By following these five steps, you can become a great investor and set yourself up for long–term success. Investing can be a tricky business, and it‘s important to remain disciplined and understand the risks involved, as well as continue to actively research and monitor your investments. With hard work and dedication, you can become a knowledgeable investor who reaps the rewards of a profitable portfolio.

Did you enjoy this article? Please share it with friends and support this site.