When Companies Pay Dividends – Declaration, Record, Ex-dividend, And Payment Dates

In this article, I will explain in simple words the most important dividend dates. If you still don’t know what a dividend is, I strongly recommend reading this article first… Everybody who invests in dividend-paying stock must know what each date means, and how it is used by investors. There are 4 important dates: declaration date, date of record, ex-dividend date, and payment date. Here are some details about each and if you still don’t understand them, you can check out the example below.

What These Dates Actually Mean

Declaration date – this is when the board of directors declares that the company is going to pay a dividend to its shareholders. This declaration includes information about the exact amount of the dividend, the record date (see below), and the date when the dividend will be paid (the payment date).

Date of record – this is the date before which you must be in the company’s shareholders book in order to receive the dividend. This date is determined by the company and it is used to determine the most important date for a dividend-paying stock – the ex-dividend date. Please note, that this is not the date up to which you must buy shares to get the dividend. For example, if the date of record is 01.01.2015, this doesn’t mean that if you purchase shares a day before this date you will catch a dividend payment. This is because each stock purchase needs a few days to be settled, depending on the exchange it is traded. This is why you need the ex-dividend date.

Ex-dividend date – this is the most important date for the shareholder, it tells who exactly catches the current dividend payment. If you buy or own the shares BEFORE this date, you GET the dividend. If you buy or own shares ON or AFTER this date – you MISS the current dividend payment. This date is determined by the exchange the stock is traded on and it’s based on the date of record (ex-dividend date = date of record minus days for settlement). This is the first date the shares are traded without the current dividend payment. Note that if you sell your stocks on this date, you will still get the dividend payment, because you owned the stocks before this date.

Payment date – this is the date when the dividends are actually paid to the shareholder by the company. All shareholders that owned the stock before the ex-dividend date get paid.

EXAMPLE:

Today is 07.09.2019 and you have 100 shares of a company called DIV. The DIV company announces its next dividend payment on 15.09.2019 (declaration date). DIV declares that they will pay a $1.10 dividend with a record date of 10.10.2019 and a payment date of 01.11.2019. The ex-dividend date is 08.10.2019 (two days before the record date because of 2 days settlement time that is needed for each transaction on the exchange to be fully processed ).

This means that if you hold your shares up to the ex-dividend date (in our case 08.10.2019), you will get a dividend payment of $110 (100 shares X $1.10 dividend per share). If you sell your shares on the ex-dividend date, you will still get the payment. If you sell your shares before the ex-dividend date, for example on 07.10.2015, you miss the payment.

Frequency of dividend payments

Many companies pay dividends once per year. They announce these dividend dates once per year respectively. Other companies pay twice per year, once per quarter, or even every month. They will announce their dates as many times as the dividend payments are.

This is it. It’s really simple, actually, you must pay the biggest attention to the ex-dividend date because it actually determines who does get a dividend and who does not.

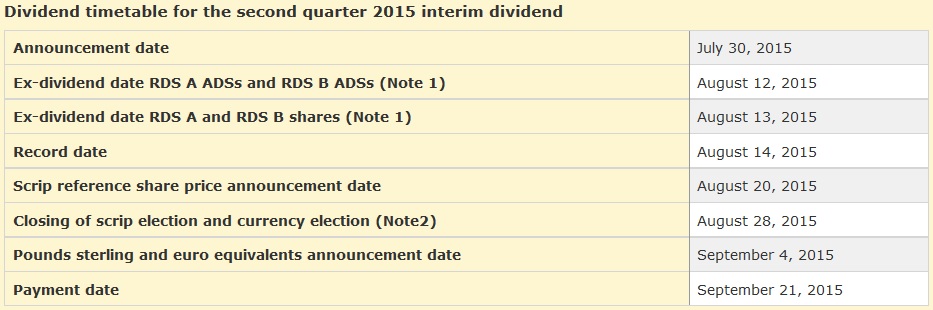

Here is some real example of how The Royal Dutch Shell company announces its dividend (from their site):

An example of dividend announcement and dividend dates of Royal Dutch Shell. There are 2 dividend dates – one for the two types of shares (a and B) the company has. The other dates are the same for A and B shares.

More About Dividend Investing

Dividend investing is a type of investment strategy that focuses on investing in stocks with a steady cash flow in the form of dividends. In exchange, these investors get regular payments while they continue to own the stocks. Over time, these recurring payments can add up and produce steady returns much the same way interest payments on bonds do.

One major benefit of dividend investing is that it can create a passive income stream for investors, which is income that does not come from their job or any other additional work. Furthermore, since the money is coming from dividends earned from stocks you own, it represents a return on your capital as opposed to interest payments that require additional borrowing.

Another major benefit of dividend investing is that it lowers portfolio volatility by introducing a regular passive income stream. In an unprotected market, when prices drop temporarily, dividends provide an offsetting source of cash flow which serves to lower the overall volatility of investments in one’s portfolio.

Additionally, dividend assets are not equally volatile as changes in stock prices tend to be more moderate than other assets over time. Dividend yields also have been found to have lower correlations with many other asset prices than other assets providing the added benefit of maintaining higher levels of diversification in one’s overall portfolio mix.

Finally, dividend investing also can be a great way for investors who rely on their principal investments for retirement income as it provides a largely uncorrelated source of income that has historically held up relatively well during times of market distress or even bear markets. Also known as “yield chasing,” this kind of income strategy ultimately makes it easier for retirees to maintain their desired lifestyle without having to dip into their principal investments too quickly or too regularly when markets are weak or down overall.

Don’t forget to share this post with friends, if you find it helpful. If you have some more questions, we are waiting for your comments below.