Category: Dividend Investing Basics

This one is another interesting and lucrative investment strategy. The so-called dividend aristocrats are a group of stocks from the S&P 500 index, that have increased the dividends they pay to shareholders for at least 25 consecutive years. Sounds good, isn’t it? Not only these companies have paid dividends for a quarter of a century, but also they increased them every single year. For the last 25 years, a portfolio containing all Dividend Aristocrats would have beaten the SP500 index big time. If you invested $1 000 in the index 25 years ago, you would have made around $7 990...

Investing in high dividend-paying stocks is a cool way to put your money to work. Why? Because it has many advantages over its alternatives like bond investing. If you are interested in all of the pros and cons of dividend investing, you can check our article on the matter here, in this post we are going to explain some key and very basic things one should know about dividend-paying stocks. If you are completely new in this field, you’d better check out our reading about the very basics of dividends. The current article is about the basic terms that characterize...

What Are Dividends? Dividends are a great way for companies to distribute their profit among their owners (shareholders). This is a way for shareholders to generate income from the companies they own. A dividend is simply a payment by a company to its shareholders, it’s usually calculated as a certain amount per share (55 cents per share for instance). So everyone who owns shares of a company that pays a dividend will get the per-share amount multiplied by the number of his/her shares. Companies by default are not obliged to pay dividends, their management decides whether or not a dividend...

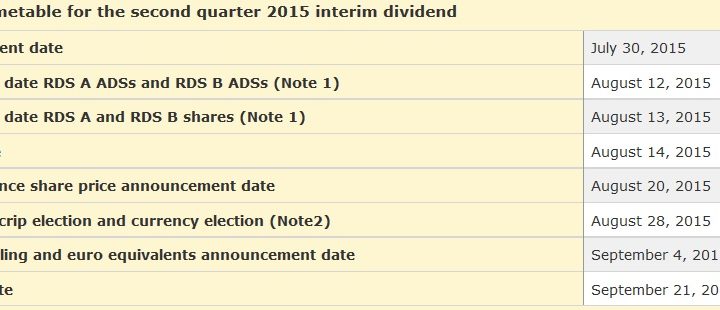

In this article, I will explain in simple words the most important dividend dates. If you still don’t know what a dividend is, I strongly recommend reading this article first… Everybody who invests in dividend-paying stock must know what each date means, and how it is used by investors. There are 4 important dates: declaration date, date of record, ex-dividend date, and payment date. Here are some details about each and if you still don’t understand them, you can check out the example below. What These Dates Actually Mean Declaration date – this is when the board of directors declares...