Monthly Compounding Interest Calculator Online

Since 2008, the economic conditions around the world have become totally unpredictable. I think there is not a big chance for something to change anytime soon. Since then, a question intensively has been arising in my head – “What would be the best way to preserve my family’s savings”. As the person in charge of this, I started to examine many different opportunities. After some time spent in analyzing various investments, I came to the decision, that opening a savings account, might be the best way to preserve wealth. Stocks have been hit really bad and many people were left with only a part of their investments there, the real estate market was one of the main causes of the economic slump, so it couldn’t be an option at all. Commodities’ prices have been going down, because of the reduced consumption and this is not going to change until a strong recovery begins.

So I ended up with several deposits in different banks. I made short-term one and two 1 year deposits in different institutions. This way, my money is relatively safe and at the same time earns decent interest.

For those of you, who plan to take a similar decision, here is a simple monthly compound interest calculator online, with which you can get a basic idea about what you could earn from your money, opening a savings account.

Monthly Compound Interest Calculator

This is a nice monthly compound interest savings calculator, that can show you how much you would have saved, after a certain period, based on how much you can afford to save each month and the interest rate of your savings account. Just enter the needed data and hit “Calculate”

The power of compounding

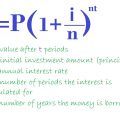

Compounding interest is a powerful tool that can help you maximize your savings and investments over time. It’s an often overlooked way to build wealth, yet it’s one of the simplest ways to do so. Compounding interest works on the concept of earning interest not only on the initial investment but also on the accumulated interest from all previous periods. In other words, you are making money off of the money you already have.

The most basic definition of compounding interest is that it’s an agreement between a lender and a borrower – usually in the case of banking or investing – where the lender pays the borrower interest on their principal investment over time. This agreement should stipulate how often and by how much this interest compounds. To better understand compounding interest, let’s look at a few examples.

Let’s assume that John invests $1000 at an annual 5% compound interest rate in a high-yield savings account with monthly compounding periods. In this example, John will receive $50 in total accrued interest after one year’s time (the 5% applied 12 times). If he didn’t withdraw any money from his savings account during this time and instead kept it compounded for another year at that same rate, his total accrued interest would be $102.50 – an extra $2.50 earned simply through compound interests’.

It’s important to note that with compounding, the more frequent and earlier you start, the more money you will be making by taking advantage of earned compound interests over time. Thus, had John started investing $1000 five years ago instead at an average rate of 6%, he would have made a total accrued income of $942 dollars after five years – almost double what he could have earned had he just started investing in Year 1 ($507). Compound interests really do add up!

Overall, compounding can be a powerful tool to take advantage of when saving or investing your money efficiently; but as with investing in general, you must be well-informed and knowledgeable before jumping into anything. Doing some research about financial vehicles like high-yield savings accounts could be beneficial for taking full advantage of compound interest benefits over time.