What Is Forex? Beginners Guide On FX Trading, Strategies, Money Management, Risks, Currency Exchanges

The FOREX (currency) market is the biggest and the most liquid financial market in the world. Its name comes from FOReign EXchange and it’s actually the place where people and institutions from all around the world exchange currencies. It’s so big that more than the worth of $5 000 000 000 000 (5 trillion US dollars) are traded every single day there. This number is huge, having in mind that all the services and goods traded in the United States for a year are around $17 trillion. Just for a little more than 3 days the FOREX market beats the turnover all US companies and people make, buying all kinds of stuff for a whole year.

The currency market is actually the place where the market value of all traded currencies is determined by the trades happening there. If the US dollar (USD) is exchanged for 120 JPY (Japanese Yen) at the moment, this means that the price of the dollar is exactly 120 yen. If someone buys dollars at 120.10 yen, this changes the world price of the dollar against the yen to 120.10. Every single deal on the market determines the current world price of a currency. And because there are hundreds of thousands of deals every single day, the price of a currency constantly changes, sometimes several times per second.

The forex market is international and it’s highly decentralized and unregulated. There is no special institution responsible for the trades there. It works 24 hours a day during the work week and it’s closed on Saturday and Sunday.

The FOREX market is decentralized which means that there is no central institution (like the SEC) regulating it. The market constitutes of all the banks and financial institutions exchanging currencies on it. This is why the forex market has no physical location.

How to trade on FOREX?

Practically only banks and other financial institutions have direct access to the forex market. If you want to trade there you must apply for a forex trading account with a financial broker. Have in mind, that not all brokers offer direct access to the market. The so-called retail forex brokers don’t even execute your currency trades, they just register the buy and sell prices of your positions and this way calculate your profit/loss from the position. If you want to be able to really trade on foreign exchange, you have to explicitly find a broker that offers this and prepare a relatively larger amount of money for this. If you just want to speculate, the retail forex broker is OK enough for this purpose.

What is forex trading (retail)?

When talking about individuals, forex trading is actually opening an account with a forex broker and trading the currency pairs that are offered on the broker’s platform for a profit (or a loss). This is called retail forex trading (for how banks and other financial institutions do it, please see below). Usually, this doesn’t involve direct access to the forex market and involves leverage from 1:4 up to 1:200, which is huge and can easily wipe your account out if you’re not an experienced trader.

Thus, retail forex trading is a popular investment activity that involves buying and selling currency in an attempt to make money from changes in exchange rates. It has become increasingly popular over the last few years due to increased access to online brokers that offer easy and cost-effective trading solutions. In this article, we’ll explain the basics of forex trading and provide some insight into why it’s a worthwhile investment for those looking to diversify their trading activities.

The most basic aspect of forex trading is the buying and selling of different currencies for the purpose of making a profit. This happens when one currency is bought with another at a higher rate than it was sold. For example, if you purchase one Euro for 1.2 US dollars, and then sell that Euro for 1.4 US dollars, you have created a profit of 0.2 dollars (or 20 cents) which is the difference between the sale price and the buy price of the Euro. These small differences between the buy and sale prices of different currencies can add up over time, giving traders great potential to make significant profits.

The forex market offers many advantages over other forms of trading due to its large size, 24-hour availability and relatively low-cost entry fees compared to stocks or commodities markets. With numerous currencies being traded around the world, there are always opportunities for traders to capitalize on price movements no matter when or where they happen. The sheer size of the market also provides enough liquidity to help ensure stable pricing even during times when other markets may be volatile or slow-moving.

In addition to having access to multiple currencies, forex trading also provides tremendous leverage (loans) from brokers so traders can potentially increase their profits significantly more than in other more restricted financial markets like stocks or commodities since transaction costs are often much lower for currency traders compared to traditional stocks or Futures markets. Leveraged trades allow traders to enter into positions worth multiples more than their original investments thus allowing them much greater potential gains but also greater risk since losses can also be multiplied unless positions are managed appropriately by taking advantage of stop/limit orders and risk management techniques.

Forex trading for beginners

Let’s start with some basics. Forex, short for foreign exchange, is the buying and selling of different currencies across borders. It’s the largest financial market in the world, with more than $5 trillion in daily transactions. Investors can take advantage of these opportunities by trying to make profits from fluctuations in foreign exchange rates.

The first step is familiarizing yourself with the basics. You should learn about different currencies, terms such as pips and leverage, and charts used to track forex prices. Additionally, you should understand how different markets move in relation to each other and which economic events cause currency rates to change.

Once you have a solid understanding of the fundamentals, you can begin trading in earnest. To open a trading account, you will need a trusted online broker. After selecting one, determine your assets and choose the lot size or volume of each transaction based on risk appetite. It is important to keep track of changes in both your profits and losses as this will help inform your trading decisions going forward.

If you are new to Forex trading, it’s important to have realistic expectations. While making money is definitely possible, getting rich overnight is not likely. Human beings tend to take risks when they believe they have an edge over the competition or when they feel confident enough to trade aggressively; this is rarely true in Forex trading unless you are an experienced trader or investor. So if you’re a newbie just starting out, it’s better to begin with small trades so that you don’t risk losing a lot of money too quickly.

You will also want to keep close tabs on economic news, particularly news related to currencies you’re interested in trading. Economic events such as central bank announcements can create volatility in the forex markets and cause prices to move quickly in one direction or another very suddenly. Knowing when such events are scheduled can help you plan your trades accordingly and give you a better chance of being successful over time.

Before digging into details on how exactly trading works, it’s important that any potential trader know the risks associated with it first: There will always be losses involved with investing activities, but those losses can be limited by following certain strategies—such as stop-loss orders—and by understanding leverage appropriately (more on that later). Only invest amounts that bring no way too much pain in case of loss!

Finally, getting started as a forex trader requires having an account with a broker who provides access to the market as well as educational materials markets such as tutorials webinars, and live trading sessions where new quotes progress into real-time trading platforms. While different brokers may offer slightly different services like variable fees or order types, most should provide everything necessary for beginning investors—including access to news platforms currency charts, and technical indicators. Most importantly when researching brokers do your own due diligence, read reviews, compare fees and withdrawal conditions, etc., before selecting one as this will affect how much money you make in your trading journey.

Major Risks involved in forex trading

The first risk that investors need to be aware of is leverage. Leverage allows forex traders to take larger positions than their actual capital base would otherwise allow, enabling them to potentially generate high returns from relatively small investments. However, it also magnifies losses—for example, if an account has a high leverage ratio of 500:1, then a decline in the market price of just 2% could result in the investor losing their entire investment. For this reason, it’s important for forex traders not to bite off more than they can chew by taking on more leverage than they can financially withstand.

Another risk posed by forex trading is volatility. Forex markets are notoriously volatile, with prices rapidly changing throughout the day and often reverting back just as quickly. This means that traders who do not adequately plan for these fluctuations can experience sudden losses that may not be easily recouped and could even lead to margin calls or bankruptcies if left unchecked. Additionally, because prices move so quickly and decisions need to be made on the spot, human errors like misreading charts or incorrect calculations can occur more frequently than in other types of trading.

Margin Calls: Margin call requirements may force traders to close out positions at prices against their desired direction in order to meet the requirements set by their broker. A margin call is issued when the amount of an account’s equity falls below a set percentage of funds used as collateral when opening a position – or when an unexpected news event causes a rapid fall in currency values against open trades. The use of leverage can greatly increase the chances of encountering margin calls, especially during volatile market conditions when currency pairs move unexpectedly against open positions.

If you’ve decided to try it, DO get some good knowledge about trading before jumping in with money you are not ready to lose!

The forex market is the perfect market

There are so big volumes in the forex market, and there are so many participants there who have equal access to information, that the forex market is the closest to the so-called perfect market or perfect competition.

Foreign Exchange Currencies Basics. How are they traded?

The currencies on the forex market are traded in currency pairs. If you need to buy a currency, you have to sell another currency and vice versa. EURUSD for example is the most popular currency pair. Each pair is a separate financial instrument. The first currency is called the base currency and the second one is called counter currency. The price of a currency pair is calculated by dividing the price of the base currency by the price of the counter currency. For example, if the price of the EURUSD pair is 1.1250 on 01.01.2015, this means that 1 euro is exactly 1.1250 US dollars. For example, if you have $1 000 and you want to exchange it for euro, you have to first sell your $1000 and then buy its equivalent in euros. On the forex market, this is represented as a sell at the EURUSD currency pair. This means that you buy euros and sell US dollars at the same time. To calculate the exact amount of euro you will receive, you need to divide your $1 000 by the EURUSD current price:

$1 000 / 1.1250 = 888.889 euro

This is how when you are exchanging your $1 000, you sell $1000 and at the same time buy 888.889 euros.

If you want to sell your euro at a later moment, you have to sell the EURUSD currency pair. On 10.01.2015 the price of EURUSD changed and it is now 1.1425. To convert your 888.889 euros you have to sell euro and buy dollars at the same time, but this time you will get more than your initial $1000 because the euro has risen in value against the dollar:

888.889 * 1.1425 = $1015.55 – you realize a $15.55 profit.

This is how:

- when the price of the EURUSD pair rises – the value of the euro rises against the dollar = the dollar falls against the euro

- when the price of the EURUSD pair falls – the value of the euro falls against the dollar = the dollar rises against the euro

There are many different currency pairs, practically any combination between any two currencies forms a currency pair. Other popular pairs are USDJPY, GBPUSD, AUDUSD, NZDUSD, USDCHF,….. etc.

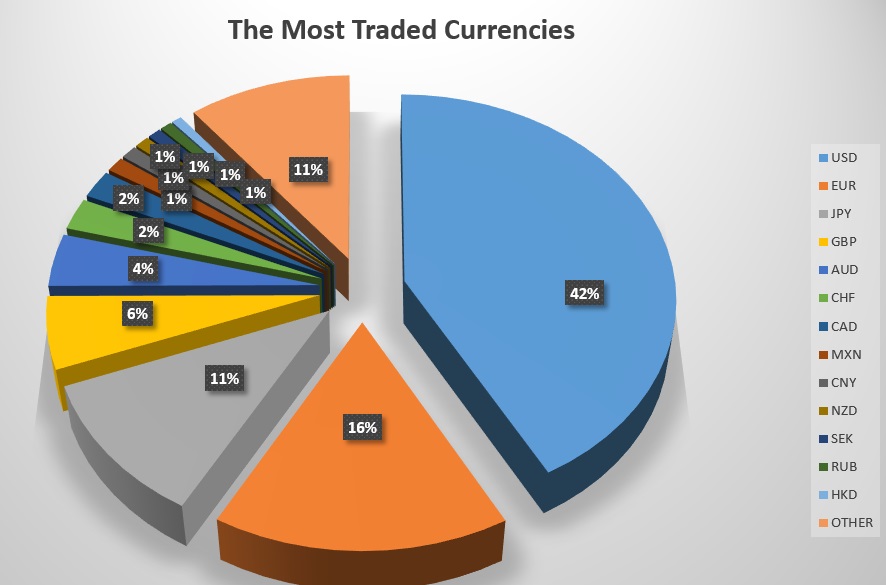

Forex majors

The following 7 pairs: EURUSD, USDJPY, GBPUSD, USDCHF, AUDUSD, USDCAD, and NZDUSD are called ‘The majors’. These are the most heavily traded pairs and they are responsible for more than 85% of the transactions on the forex market. They are also the most liquid currency pairs. The EURUSD pair is currently the absolute leader among them, more than 28% of all transactions are with this pair, according to the Bank for International Settlements (BIS).

Some Major Forex Trading Strategies For Retail Trading

Forex trading strategies vary depending on individual traders. It is important to develop a strategy before committing to a trade in order to maximize potential profits and minimize losses. There are many strategies available and it is important to understand them before beginning trading. Here are some of the top forex trading strategies:

1. Trend-Following Trading Strategy – Trend-following is one of the most popular forex trading strategies. This strategy involves identifying and following trends in the market and taking advantage of them to profit from price changes. It requires identifying when trends are starting, ending, or changing direction which can be difficult as prices can move quickly and dramatically.

2. Carry Trading Strategy – Carry trading is another popular forex trading strategy that involves holding a currency for a relatively long period of time to take advantage of the interest rate differentials between two currencies. This can be an effective method as it allows traders to take advantage of small immediate profits while still holding onto the currency.

3. Scalping – Scalping is an aggressive online forex trading strategy that involves opening and closing multiple positions in quick succession with the aim of making small profits from each trade. This strategy requires high amounts of concentration and discipline, as small price movements can lead to large losses if not managed properly.

4. Hedging – Hedging is a risk management technique that aims to reduce potential losses by taking opposing trades in different instruments or currencies. This strategy can help investors minimize their total loss exposure as closing out one trade begins covering some of the losses from the other trade, reducing overall risk management costs.

5. News Trading – News trading is one of the oldest forms of forex trading strategies, involving analyzing news reports and economic data releases to find new opportunities in the market. This technique requires quick decision-making due to its short-term nature, however with the right analysis news trading can be highly profitable for investors looking for short-term gains in markets derived from market-moving news releases or events.

These are just some examples of top forex trading strategies, however, there are many other methods available that are suitable for different types of investors depending on their objectives, preferences, and experience levels with online forex trading. Ultimately it’s important to do careful research before embarking on any investment journey and consider professional advice where necessary before making any decisions that could impact your financial future!

Money management in forex trading

Investing in foreign currency exchange markets, or forex, can be incredibly lucrative but it also carries significant risk. Money management is an important skill to master if you want to succeed in forex trading. Here, we discuss some of the essential money management principles you should adopt when trading forex.

Beginners in forex trading should always remember to practice risk aversion. Never risk more than 1-5% of your capital on any single trade and never margin more than 10%. This will help you survive volatile markets and minimize potential losses. It’s also important to have a trading plan that outlines your strategy, capital limits, and stop-loss levels before you enter into any trade. This will help you retain discipline throughout the process.

Another important money management technique is diversification. Investing all your capital in a single currency pair is considered a risky move. Instead, it’s better to build a portfolio comprised of a variety of currencies and financial instruments. This allows you to spread risk and maximize your returns over the long term.

Using stop-loss orders when trading forex is also essential. Stop loss orders enable you to exit trades that are not going in your favor before they go into deep losses. By setting stiff stop loss limits that are no more than 2-3% below the entry price, you can limit potential losses and protect yourself against turbulent markets or sudden corrections in market prices.

Finally, limit your emotional involvement in forex trading and never invest with borrowed money. Investors can often get overly confident when they’re up on a winning streak, while they may become overly pessimistic if they’re stuck with consecutive losing trades – both attitudes can have serious financial consequences if left unchecked. Risk Management, discipline, diversification, and emotion control are the key components for successful forex traders – all principles that should be factored into any successful money management strategy for trading forex.

Some major forex brokers

1. Interactive Brokers: This US-based broker is a premier choice for many traders due to its low trading fees, advanced platform offering, a wide variety of financial products, and excellent customer support. Interactive Brokers also allows users to trade in multiple currencies or different trading platforms depending on the specific needs of each trader. It’s usually suitable for larger investors as they provide real access to the forex market that involves some minimal trade sizes and fees.

2. Oanda: Oanda is renowned for its innovative approach to currency trading, with a platform that provides a full range of charting tools, flexible trade options, and advanced order types. Clients can also take advantage of unique features such as automated trading and integrated economic calendars.

3. Forex.com: This broker stands out from other contenders due to its wide range of global markets and an impressive selection of research and trading tools suitable for all kinds of investors from novice traders to professionals. At Forex.com clients can choose from 20 base currencies for their accounts, with support for up to 90 currency pairs.

4. Plus500: Plus500 is great for those looking to trade CFDs – contracts for difference – on more than 2200 global markets including cryptocurrency CFDs. It offers both proprietary desktop platforms (Plus500 Webtrader) as well as applications for mobile devices such as tablet or smartphone browsers via Apple’s App Store or Google Play Store).

5. FXCM: Established in 1999 this UK-based broker provides a broad range of customers with a quality product offering including web-based trading platforms such as TradeStation 9, desktop platforms such as MetaTrader 4 (MT4), mobile apps such as NinjaTrader 8 plus access to educational content and research services powered by TradingView charts. FXCM clients also benefit from low fees per trade with no hidden charges or fees outside the spread cost structure which makes it popular among active traders seeking larger volumes or dedicated hedging strategies such as delta hedging or straddling options spreads etc.

Some of the top trading platforms

Some brokers use their own platforms, others use generic platforms like MT4. However, here are just some of the most popular trading softwares out there:

1. MetaTrader4 (MT4) – This is one of the most popular, and one of the oldest trading platforms among traders, due to its user-friendly interface, automated trading capabilities, and access to a range of analysis tools. MT4 offers a wide range of educational material including tutorials and webinars to help you learn how to use the features. MT4 also supports different types of trading accounts as well as multiple language options, making it suitable for both experienced and novice traders.

2. Plus500 – Plus500 is one of the leading CFD providers in the industry and offers a fully-featured forex trading platform with features such as tight spreads, fast execution speed, and real-time price data. For beginner traders that may be new to forex trading, Plus500 provides an intuitive demo account with virtual funds available to practice before you start investing with real money.

3. eToro – eToro is a unique online brokerage service that attracts both individual investors as well as professional money managers looking for competitive spreads, low fees, and access to multiple asset classes on one platform. Dubbed as ‘the world’s leading social investment network’ eToro also stands out due to its social features such as copying other successful traders or copying their trading strategies, allowing investors up-to-date market news as well as encouraging interaction between users in order to gain knowledge from each other’s experiences when investing in assets such as forex currencies.

4. Another worthy mention would be OANDA – listed but not limited to powerful features like interactive charts that let you draw patterns on personalized charts equipped with custom indicators; margin calculation capabilities & automated strategies such as trailing points or spread tools, etc.

5. Next on our list is cTrader. This platform was designed specifically for users located in non-English speaking countries, offering an array of languages including Spanish, French, Japanese, and Russian for increased accessibility. cTrader also offers sophisticated order types, trade automation tools, and advanced technical indicators to make trading easier for more experienced users as well. Additionally, its rich interface provides detailed market depth analysis along with attractive charts that make it easy to track performance over time.

6. Another great option is NinjaTrader 8 (NT8). This platform offers extensive charting capabilities with dozens of technical indicators and drawing tools as well as automated strategies that make it easier to engage in algorithmic trading. NT8 also comes with an expansive set of order types including stop loss and limit orders designed to help protect your profits or reduce risks when needed. The built-in risk management tools add a level of safety that makes this a great option for those looking for reliable protection from losses or volatility during their trades.

Why Do People And Companies Use Forex?

For example, a European company wants to buy materials from the USA, where payments are made in US dollars. The EU company operates with euros and it has to buy dollars, in order to purchase the required materials from the US.

Another example is when you go on a vacation to a different country. You have to change some of your local currency into the other country’s currency, in order to be able to buy goods and services there.

Don’t forget to check out some of our other posts about the forex market. If you think this post was interesting, please, share it with friends and help our site grow this way, too. Thanks!

This article is not financial advice, it’s for informative and educational purposes only! FOREX trading is a high-risk activity and you may lose all the money in your account practicing it. Make sure you have super solid knowledge about it if you’ve decided to do it! We’re not affiliated with any of the mentioned here FX brokers and platforms and we don’t provide any guarantees about their services.