What Company Type Should You Choose For Your Start-Up

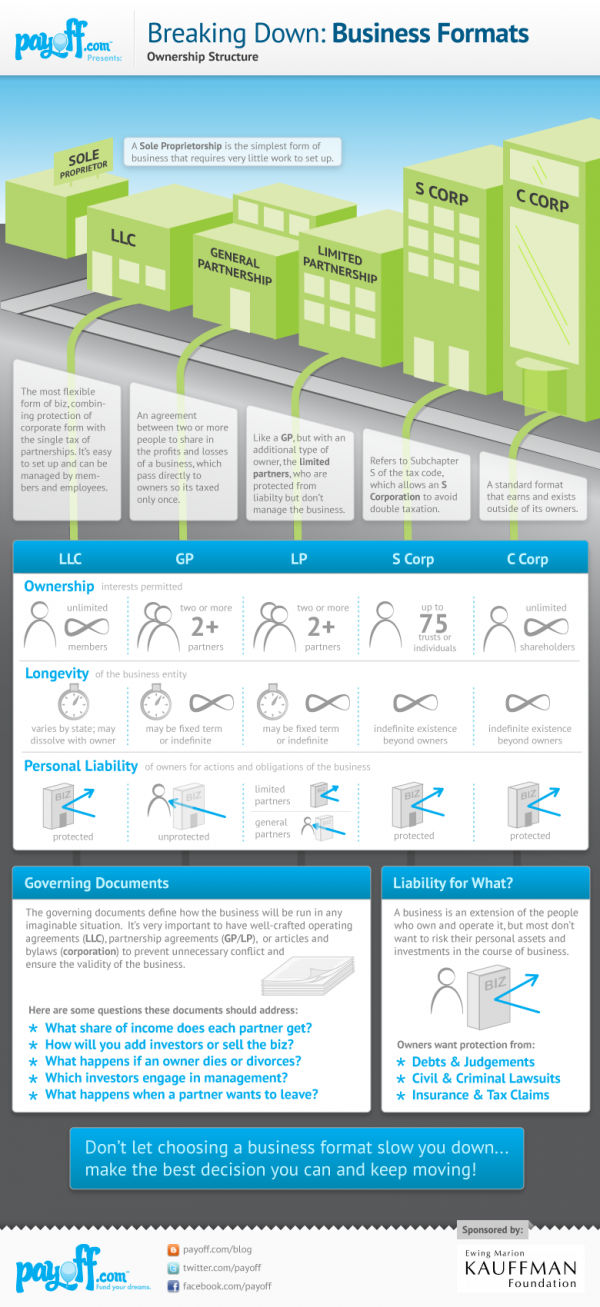

You have a great business idea and you are ready to build a business around it. You know how to make a great product or service, but are you wondering what type of company should you register? Should it be an LLC? Or should you choose to start a sole proprietorship? These are some standard questions every starting entrepreneur should ask herself. The right answers may be crucial for the successful future of your business. So, to make the decision easier for you, we found an infographic that will show you all the basics of major business types in the US as a sole proprietorship, limited liability company (LLC), general and limited partnerships, S and C corporations. Below are not the very details, but you can see some major advantages and disadvantages of these business forms. This way, we hope, you get a more clear view of the matter and this helps you find the legal form that suits you the best. This infographic was created by the guys and gals from payoff.com, they did a nice job here. Please, consider sharing it using our beautiful social buttons.

Company Types in the US

Company Types in the USA

1. Sole Proprietorship: A business run and owned by an individual.

2. Partnership: A business owned and managed by two or more people.

3. Corporation: An entity created by a state and subject to taxation and regulations.

4. Limited Liability Company (LLC): A business structure that is separate from its owners and provides limited liability to its shareholders.

5. Cooperatives: A business entity owned by and operated for the benefit of its members.

6. Nonprofits: An organization that does not operate for profit and is exempt from federal income taxes.

7. Series LLC: A type of LLC that allows each line of business to be operated and taxed separately from the other.

8. Professional Limited Liability Company (PLLC): A form of LLC created for licensed professionals such as physicians, attorneys, and architects.

9. S Corporations: A corporation that is treated as a disregarded entity for income tax purposes.

10. Limited Liability Partnership (LLP): A business structure in which two or more partners have limited personal liability.

If you liked this post, don’t miss checking out our cool suggested posts below.