How To Invest In The Dividend Aristocrats – Directly Or Through ETFs

This one is another interesting and lucrative investment strategy. The so-called dividend aristocrats are a group of stocks from the S&P 500 index, that have increased the dividends they pay to shareholders for at least 25 consecutive years. Sounds good, isn’t it? Not only these companies have paid dividends for a quarter of a century, but also they increased them every single year.

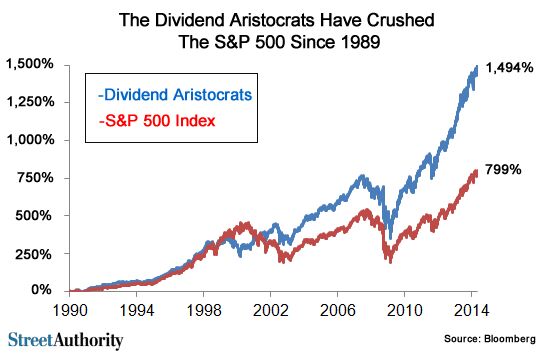

For the last 25 years, a portfolio containing all Dividend Aristocrats would have beaten the SP500 index big time. If you invested $1 000 in the index 25 years ago, you would have made around $7 990 in 2014. If you invested in The Dividend Aristocrats stocks the same amount, you would have made nearly twice – around $14 494 by the year 2014. You can see how both of these investment scenarios would have developed on the following chart:

The chart shows the growth of The Dividend Aristocrats compared to the growth of the SP500 index for the last 25 years. Source:

How To Invest In the Dividend Aristocrats?

Well, we have a cool investment strategy, but now comes the question of how we can put it into action. How can one invest in the Dividend Aristocrats? Well, this turns out to be not such a trivial thing. The list of all of the stocks contained 52 companies in 2009, then 42 companies in 2010, and 54 companies in 2014 (see all current companies in the full list of aristocrats below ). What I am trying to say is that the list constantly changes and maintaining a portfolio of all the stocks that are on the list at every point in time might be not that easy and sometimes expensive. However, here are

3 ways to invest in the Dividend Aristocrats

1. Invest in Dividend Aristocrats ETF

There are ETF funds that always maintain a portfolio of all Dividend Aristocrats, most of them track the S&P 500 Dividend Aristocrats Index, introduced in 1989. You can invest in such a fund and leave all the work of managing the portfolio to the professionals. This might be the best option for people who have no idea of how the stock market works or how to buy shares. ETFs also have some advantages like low maintenance fees and tax benefits, so you should really consider this option. Such funds are:

SPDR S&P Dividend (SDY)

The ProShares S&P 500® Dividend Aristocrats ETF (NOBL) (0.78% expense ratio)

Vanguard Dividend Appreciation ETF (VIG)

2. Buy the stocks directly

As we said earlier, you can invest directly in the stocks of all Dividend Aristocrats companies. You can split your money into 54 parts (currently the list consists of 54 stocks) and invest each piece of cash in one of the companies. Good so far, but the bad thing is that the list is constantly updated every year. This means that every year, you should change your portfolio in order to copy the changes to the list. This might be an expensive procedure for smaller portfolios. The average cost of buying a stock in the USA is around $ 8. This means you must spend at least $432 to buy every company on the list at first and around $50-$100 to maintain your portfolio every single year after. These expenses might be much more compared to the 0.78% expense ration of the NOBL fund.

The Dividend Aristocrats List and Index (2022)

Dividend Aristocrats are companies that have increased their dividend payments for 25 consecutive years or more. These stocks comprise the S&P 500 Dividend Aristocrats Index and they offer investors a unique opportunity to capture reliable and consistent income with stability. Now, you may be wondering which these companies actually are. Here is a list of all dividend aristocrats in 2022

| COMPANY | SECTOR | YEARS OF DIVIDEND GROWTH | DIVIDEND YIELD |

| 3M Co. (MMM) | Industrials | 64 | 3.70% |

| A.O. Smith Corp. (AOS) | Industrials | 29 | 1.50% |

| Abbott Laboratories (ABT) | Health care | 50 | 1.50% |

| AbbVie Inc. (ABBV) | Health care | 50 | 4.50% |

| Aflac Inc. (AFL) | Financials | 39 | 2.50% |

| Air Products and Chemicals Inc. (APD) | Materials | 40 | 2.60% |

| Albemarle Corp. (ALB) | Materials | 28 | 0.70% |

| Amcor PLC (AMCR) | Materials | 39 | 4.20% |

| Archer-Daniels-Midland Co. (ADM) | Consumer staples | 48 | 2.10% |

| Atmos Energy Corp. (ATO) | Utilities | 35 | 2.60% |

| Automatic Data Processing Inc. (ADP) | Information technology | 47 | 2.00% |

| Becton, Dickinson & Co. (BDX) | Health care | 50 | 1.30% |

| Brown & Brown Inc. (BRO) | Financials | 28 | 0.60% |

| Brown-Forman Corp. (BF-B) | Consumer staples | 38 | 1.10% |

| Cardinal Health Inc. (CAH) | Health care | 35 | 3.60% |

| Caterpillar Inc. (CAT) | Industrials | 28 | 2.20% |

| Chevron Corp. (CVX) | Energy | 35 | 4.10% |

| Chubb Ltd. (CB) | Financials | 29 | 1.60% |

| Church & Dwight Co. Inc. (CHD) | Consumer staples | 26 | 1.00% |

| Cincinnati Financial Corp. (CINF) | Financials | 62 | 2.20% |

| Cintas Corp. (CTAS) | Industrials | 38 | 1.00% |

| The Clorox Co. (CLX) | Consumer staples | 46 | 3.20% |

| The Coca-Cola Co. (KO) | Consumer staples | 60 | 2.70% |

| Colgate-Palmolive Co. (CL) | Consumer staples | 60 | 2.20% |

| Consolidated Edison Inc. (ED) | Utilities | 48 | 3.70% |

| Dover Corp. (DOV) | Industrials | 66 | 1.20% |

| Ecolab Inc. (ECL) | Materials | 30 | 1.10% |

| Emerson Electric Co. (EMR) | Industrials | 60 | 2.10% |

| Essex Property Trust Inc. (ESS) | Real estate | 28 | 2.70% |

| Expeditors International of Washington Inc. (EXPD) | Industrials | 28 | 1.10% |

| ExxonMobil Corp. (XOM) | Energy | 38 | 4.30% |

| Federal Realty Investment Trust (FRT) | Real estate | 50 | 3.50% |

| Franklin Resources Inc. (BEN) | Financials | 41 | 3.70% |

| General Dynamics Corp. (GD) | Industrials | 31 | 2.20% |

| Genuine Parts Co. (GPC) | Consumer discretionary | 66 | 2.50% |

| Hormel Foods Corp. (HRL) | Consumer staples | 56 | 2.20% |

| Illinois Tool Works Inc. (ITW) | Industrials | 51 | 2.20% |

| International Business Machines Corp. (IBM) | Information technology | 26 | 4.80% |

| Johnson & Johnson (JNJ) | Health care | 60 | 2.50% |

| Kimberly-Clark Corp. (KMB) | Consumer staples | 49 | 3.50% |

| Linde PLC (LIN) | Materials | 29 | 1.40% |

| Lowe’s Cos. Inc. (LOW) | Consumer discretionary | 48 | 1.40% |

| McCormick & Co. (MKC) | Consumer staples | 36 | 1.40% |

| McDonald’s Corp. (MCD) | Consumer discretionary | 45 | 2.10% |

| Medtronic PLC (MDT) | Health care | 44 | 2.50% |

| NextEra Energy Inc. (NEE) | Utilities | 26 | 2.00% |

| Nucor Corp. (NUE) | Materials | 49 | 1.70% |

| Pentair PLC (PNR) | Industrials | 45 | 1.40% |

| People’s United Financial Inc. (PBCT) | Financials | 29 | 3.40% |

| PepsiCo Inc. (PEP) | Consumer staples | 49 | 2.50% |

| PPG Industries Inc. (PPG) | Materials | 50 | 1.50% |

| Procter & Gamble Co. (PG) | Consumer staples | 66 | 2.20% |

| Realty Income Corp. (O) | Real estate | 27 | 4.40% |

| Roper Technologies Inc. (ROP) | Industrials | 29 | 0.60% |

| S&P Global Inc. (SPGI) | Financials | 49 | 0.80% |

| Sherwin-Williams Co. (SHW) | Materials | 43 | 0.80% |

| Stanley Black & Decker Inc. (SWK) | Industrials | 54 | 1.90% |

| Sysco Corp. (SYY) | Consumer staples | 42 | 2.30% |

| T. Rowe Price Group Inc. (TROW) | Financials | 36 | 2.90% |

| Target Corp. (TGT) | Consumer discretionary | 50 | 1.70% |

| VF Corp. (VFC) | Consumer discretionary | 50 | 3.20% |

| W.W. Grainger Inc. (GWW) | Industrials | 51 | 1.30% |

| Walgreens Boots Alliance Inc. (WBA) | Consumer staples | 46 | 3.80% |

| Walmart Inc. (WMT) | Consumer staples | 49 | 1.60% |

| West Pharmaceutical Services Inc. (WST) | Health care | 29 | 0.20% |

————————————————————-

Dividend aristocrats are attractive investment options for those looking to capture reliable and consistent income with stability. However, it’s important to remember that these stocks come with their own set of risks. As with all investments, ensuring that dividend aristocrats fit within your overall investment strategy is essential before deciding to invest.

Did you like this article? Please, consider spreading it around on some social sites. This way you will help us write more like it.