What Are Real Estate Investment Trusts (REITs) And How Do They Work?

Times have changed — what used to be an object of interest only to businessmen and financiers is now open today to a wider audience. Making good financial investments is a necessity. People have different reasons to invest: for financial freedom (making their money work for them), long-term financial goals (college savings, etc.), and retirement. Everybody has different risk tolerance when it comes to investing. Fortunately, there are a lot of options in which people, not just businessmen, can invest.

What are real estate investment trusts (REITs)?

Real estate investment trusts (REITs) are companies that purchase, manage, and develop real estate assets, such as apartments, shopping centers, office buildings, and other types of properties. REITs are often traded on the stock exchange, and investors can purchase shares of the company to gain exposure to real estate. A significant portion of the company’s profits must be paid out to shareholders in the form of dividends. REITs are mainly known for their ability to generate high yields ( dividend income) for investors.

The advantage of real estate investment funds is that they allow investors to earn a part of the income produced through real estate without the need to buy or own commercial and actual real estate property. Shareholders in real estate can earn a part of the earnings of the company without financing large-scale real estate properties. Apartments, hotels, resorts, shopping malls, warehouses, and storage facilities can be considered income-producing real estate assets. Because of this there, real estate investment trusts can offer retail REIT, residential REIT, office REIT, etc.

How do real estate investment trusts work?

Real Estate Investment Trusts, or REITs, are a popular form of investing that offer a range of benefits to those looking to expand their portfolio and make a passive income. REITs offer you the chance to invest directly in real estate or have a company manage the associated risks for you. Essentially, a REIT is a company that owns and operates income–producing real estate such as office buildings, apartment complexes, or shopping malls. They provide investors with regular income through dividends, as well as potential capital appreciation. Here, we provide an overview of how these trusts work, the benefits they offer, and the different types available. When it comes to REITs, investors can choose from several different types. Equity REITs own and manage income–producing real estates, such as office buildings, shopping malls, apartments, or even vacation homes. Mortgage REITs lend money for real estate–related investments and are typically less risky than equity REITs. Hybrid REITs are a blend of both the above forms of investing. REITs offer numerous benefits to investors. They provide a great way to diversify investments, as they allow investors to get exposure to real estate without needing to own a physical property. Additionally, they provide an opportunity to make regular income through dividend payments and the potential for capital appreciation. As with any form of investing, there are risks associated with REITs as well, so it is important to understand them before investing. When investing in a REIT, it is important to consider the fees associated with it. Most REITs have annual fees and management fees which can have an impact on the overall returns. Additionally, there are certain taxes and regulatory requirements that need to be taken into consideration when investing in REITs. Understanding the costs associated with a REIT can help you to make the most of your investment. One final point to consider when investing in REITs is the time horizon for your investment. While REITs offer an opportunity for short–term income and growth, they are best used as part of a long–term investment strategy. As such, you should understand the time horizon for any REIT you are considering investing in, and be sure to factor in fees and taxes when calculating your potential return. REITs offer a range of benefits, including regular income through dividends, the potential for capital appreciation, and diversification opportunities. However, to get the most benefit out of this type of investment, you should understand the different types of REITs available, consider the associated fees, and understand your desired time horizon for the investment. By following these steps you can ensure you get the most out of your real estate investment trust investments.

Example:

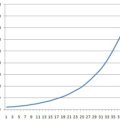

You have a great idea for building a great building. But as often happens in life, the idea is present, but the money is not. You need $1 million for the project. This is a no-brainer for you because you know about REITs. You can find such a fund and try to collect the money from private investors. You plan to issue 1 000 000 shares at $1 each, and this is how you will get the funds for your building. If you spread the idea and people find it a good deal, they can buy shares with you from your company and become your partners. If you sell all of the shares of the REIT, you will have the money and you can start building. When the estate is ready, you can rent it and make profits from it. 90% of these profits are paid to the shareholders/investors who are actually the owners of the building. For example, if your REIT company makes $100 000 in profits in the first year, you will have to pay $90 000 to the investors as dividends. This means 9 cents per share of your trust. This is how everyone can profit from big real estate projects, even with small amounts of money. And this is how really big projects can happen, even financed by ordinary people like you and me.

How are REITs traded?

Real estate investment funds are traded on stock exchanges but there are also privately or publicly listed REITs. Privately Listed shares are sold directly to investors (non-exchanged traded REITs). Shares of publicly traded trusts can be bought freely on the stock exchanges, like the shares of any other company. Companies who wish to qualify as a real estate investment fund should have the bulk of their earnings or profit generated by real estate assets. They are also required to distribute dividends annually that cover 90% of their taxable income. For the first year, they should have a minimum of 100 investors. The 5 top investors in real estate investment funds should not hold more than 50% of the shares in a company. Real estate investment trusts are managed by trustees and a board of directors.

What are the Different Kinds of REITs?

Real estate investment trusts or funds are generally classified into 3 categories.

1. Equity REITs: They own commercial or income-producing real estate such as warehouses, apartments, hotels, and storage facilities. They typically invest in their own properties. The principal revenue of equity REITs comes from the rent of their tenants. Part of their revenue comes from the sales of the real estate that they manage or own. The companies who own commercial real estate will first pay the expenses incurred by operating their properties, after which they will pay the excess income as dividends to their investors.

2. Mortgage REITs: These companies invest in commercial and residential mortgages and other mortgage-related securities such as residential and commercial mortgage-backed securities (RMBs and CMBs). Compared to equity REITs, they use more borrowed capital (higher leverage). Mortgage REITs provide funds to real estate owners directly in the form of a mortgage.

3. Hybrid REITs

Hybrid REITs combine the technique and strategies used in equity and mortgage REITs through investment in both mortgages and properties.

How to Invest in Real Estate Investment Trust?

As we mentioned, you can invest in REITs by buying shares of such businesses on stock exchanges. This is no different than buying the shares of any other publicly traded company. All you need is a brokerage account and some money.

What to Take into Account when Investing in REITs

Before investing in REITs, the potential investor should first be thoroughly familiar with the strategies of the kinds of real estate investment funds. They should also consider their own financial situation. Although investments are a good choice, in the long run, the need for savings, emergency funds, and insurance is still a priority. In any kind of investment, the probability of loss is always present. In addition, the shareholder or investor should shoulder all fees involved in their investment. You will also have to pay the needed taxes on the dividends and profits you earn from your investment.