What Is The Stock Market And How Does It Work? A Simple Definition for Beginners

Stock markets are crucial for business. For many years, the markets have been one of the main sources of financing for companies and at the same time a main source of wealth for many individuals. In today’s world, it’s really important to know how the stock market work, not only because there are attractive investment opportunities there, but also to understand how modern economies operate.

What Is A Stock Market And How Does It Work? The Basics Of Financial Markets

Stock markets are one of the greatest inventions of our capitalistic world. They work so simply and at the same time, nobody can predict them. You trade financial instruments there, but at the same time, it’s more of a social ecosystem than you can’t even imagine. Its moves are driven by almost anything that happens to our society – from economic fundamentals to emotions in our brains and future expectations. The market reflects not only the financial world but is a barometer for the development of our society as a whole.

What Is A Stock Or A Share

Before taking a look at how the stock market works, let’s see what stocks are. Stocks (also called shares) are simply parts of companies. If you own Google stocks, for example, you practically own a piece of Google Inc. and all its profits, assets, and liabilities it has. If all the shares of Google were 100 and you owned 2 of them, you would have 2% of the whole company. All public companies (like Google Inc., IBM, Apple, etc.) have issued a certain number of shares/stocks and if you want to buy some, you do this on the stock market. These companies are called public because everybody (the public) can buy their stocks.

But why would a business want to issue shares and sell them to people?

Companies sell parts from their businesses mainly for money. Imagine that you have a great business (CoolBusiness Inc.), but you don’t have enough cash to grow it. Banks don’t want to lend you money, because you are small, you have no credit history, or whatever else. What would you do? You can sell a part of your business on the stock market for example. You can split the company into a certain number of shares (let’s say 1000) and offer them to people, who are interested (the investors) at a certain price (let’s say $10 each). The investors get a piece of the prospective business and its future earnings and you get the money to run it. In this example, you can offer 500 shares (50%) to investors and keep the rest 500 (the other 50%) for yourself. In this case, you will get 500 x $10 = $5 000 to finance CoolBusiness’ activities, but you will own just half of your business after that. If you borrowed money, you would have kept 100% of the business, but you would have to pay it back. By issuing shares, you just sell a piece of your company and you don’t need to return the money.

What Is The Stock Market

A stock market is simply a place where businesses and investors meet. There you can buy or sell pieces of public companies (their shares). It’s the place where public companies raise cash from the public and institutional investors. This way of funding is called equity financing.

Stock markets, also called stock exchanges are regulated by the law and closely watched by a regulatory body – in the US it’s SEC (Securities and Exchange Commission) for fraudulent activities. Regulatory bodies ensure the fair play of all participants in the exchanges. Different countries usually have their own stock exchanges, there are three in the United States:

NASDAQ – (National Association of Securities Dealers) – is an electronic exchange where usually stocks of tech companies are traded.

NYSE – (New York Stock Exchange) – located in New York, it’s the world’s largest stock exchange by the market cap of the companies traded there.

NYSE MKT – the former AMEX – American Stock Exchange.

Some European stock exchanges are:

The Frankfurt Stock Exchange – boerse-frankfurt.de

EURONEXT – euronext.com

To trade on one of these stock exchanges, you don’t have to go to where they are located. In today’s world, you can do this online, by just opening an account with a broker. This is how people from all around the world can buy or sell shares there and actually finance public companies. Listing a business there exposes it in front of millions of potential investors and also increases its popularity. It’s obvious that if you have a prosperous company, you won’t be experiencing a lack of cash there. This is how good companies get more attention than bad ones. Something like a financial evolution happens there, the vital and potential survive, and the weak suffer.

In order for a company to get listed on a stock exchange and be traded there, it should become a corporation first and then make an IPO (Initial Public Offering). In our case with CoolBusiness Inc., you make an IPO for $5 000, selling 500 shares at $10 each. Once an investor buys a part of your shares, she can hold it or sell it to someone else. Your company acquires money only by its IPO if a shareholder sells the shares she bought on the IPO, she sells it on the so-called ‘secondary market’. It’s the same exchange, but ‘secondary’ means that the shares are not traded for the first time. All following trades after an IPO happen on the secondary market.

What happens in the secondary market?

If the IPO of our CoolBusiness Inc. is successful, the company gets $5000 from its first investors and here the game ends for it, just for now. All shareholders now can hold the shares they bought at $10 and wait for dividends or capital gains (an increase in the price of the shares), or sell them to other investors on the market. Everybody (with a brokerage account) now can place orders to buy from the already issued shares of CoolBusiness Inc. If the business of the company is going well, the prices of shares will go up, because more and more people will be willing to pay more and more money for a piece of a more and more successful business. As we said earlier, as a shareholder you own a piece of the business, its earnings, and assets. As it grows, you own more assets and earnings with your shares and this is why their price rises. The opposite is also true if your business loses money, its assets will go lower and your shares become pieces of a smaller and smaller business with less and less amount of assets. This is why their price will go down.

The total sum of the prices of all shares forms the market capitalization of a company. CoolBusiness Inc. has 1 000 shares in total ( it doesn’t matter that only half of them are sold to investors) and the price of one share is $10 on the IPO day. This sets the market capitalization (value) of the company at 1000 shares * $10 each = $10 000. The market cap changes when the share price changes. If the price reaches $11, the market value will reach $11 000. This is how the market sets a price for your entire company.

Example:

Imagine that the shares of CoolBusiness Inc. trade at $11 on the secondary market and the company’s profits for the last year are $400. The market capitalization of the company is $11 000 at this price. So if you buy the whole company, it can bring you these $400 of profits, which is around a 3.6% return on your investment:

($400 / $11 000) * 100 = 3.6% ROI (return on investment)

But after the first year, CoolBusiness Inc. manages to double its earnings up to $800. The net profits would yield a 7.2% return on investment if the price stays at $11 (and the market cap at $11 000):

($800 / 11 000 ) * 100 = 7.2% ROI

This might be attractive for some investors and they might be willing to pay more than $11 and buy shares. Also, you will not want to sell your shares at $11 anymore. This is how the price will start going up to a place in which the buyer and the seller feel OK with it. For example, if the normal return on investment is 3.6%, the new price has to get up to $22 per share (market cap of $22 000) for such a return to be achieved:

($800 / $22 000) * 100 = 3.6% ROI

The market prices are driven by the supply and demand of shares. If a company makes bigger profits, the demand for its shares increases, the supply lowers and the price goes up. If an investor buys some shares when the price is $11 and after that sells them when the price reaches $22, she makes a capital gain of $22-$11=$11 per share. When the profits get lower, the same turn in action but in the opposite direction. The price gets lower and investors make a capital loss. Of course, this is just a simple example of how the stock market works. Actually, the forces that move share prices are endless, they could be financial (profits, revenue…), macroeconomic (trade deficits, public debt…), social (birth rate, diseases…), emotional (fear, greed…), and all other. They are so many that nobody is able to predict future prices with 100% accuracy. There is always a risk when investing, but this is why returns here are potentially higher.

How to evaluate companies, stock valuation methods

To make good investments and make money, you should know if the market price of a certain company is a good deal or not. How to know that? There is no easy answer… There are different methods for evaluating a company like calculating some market coefficients (like P/E, P/B), evaluating future discounted cash flows, and many more. But no method can be 100% sure, because of the many unknown and unpredictable factors that drive the markets. However, objective factors like future earnings, revenue, and income potential play a major role in setting up prices.

Stock market investment strategies

Because there are so unknown and unpredictable things that may move share prices, there are many different investment strategies out there. Some are long-term investors, they take advantage of the power of compounding and bet that a company will grow in the long run, no matter the temporary bumps and dumps of profits and sales. An example of such a strategy is one called ‘Buy and hold’. Others don’t like freezing their money for so long, they buy shares and sell them after an increase in their price – the ‘Buy low and sell high’ strategy. Third buy and then immediately sell the shares after even a small increase in the same day. These are called intraday traders. Others practice the so-called value investing and so on and so on… Actually, there are thousands of different strategies, the Dogs of the Dow is an interesting one, for example.

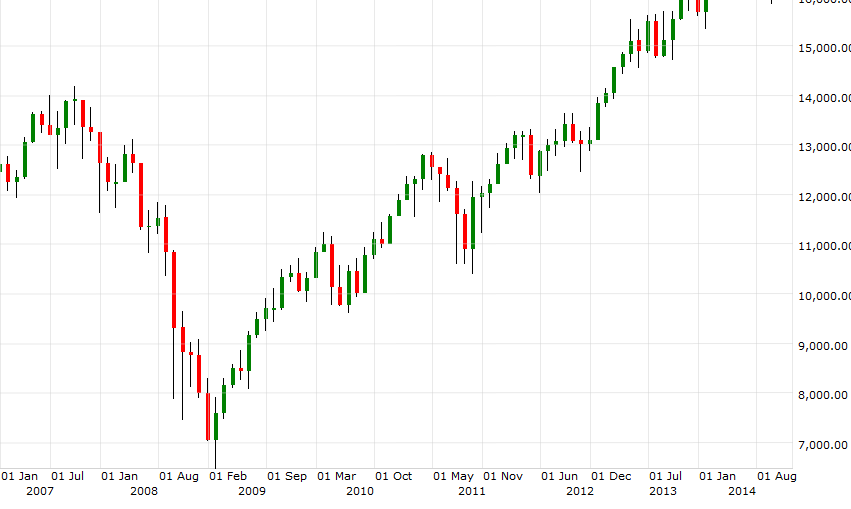

Stock Market Crashes and Crysis

Stock markets do crash from time to time. There are no clear reasons for why this happens, but it happens and this will continue in the future. Many economists and financiers have tried to explain these crashes, but they still remain unpredictable and inevitable. More about these strange market situations we will discuss here: https://businessideaslab.com/stock-market-crash/.

Some of the best books about the stock market

First up is ‘The Intelligent Investor’ by Benjamin Graham, which is considered one of the classics of investing literature. In it, Graham lays out his principles for “value” investing, which is the foundation for much of Warren Buffet’s success. He provides clear guidance on how to identify investment opportunities and how to manage your portfolio long-term in order to maximize returns. A must-read for any investor who doesn’t want to take unnecessary risks.

Next on the list is ‘One Up On Wall Street’ by Peter Lynch, which emphasizes finding companies before they become the next Silicon Valley stars. Through personal anecdotes and practical advice, Lynch teaches readers how to find good investments that have predictability without needing a Ph.D. in economics. It’s a must-read for novice investors looking to get their feet wet with stock picking and provides insight into the minds of some of Wall Street’s winning investors.

For those seeking advanced strategies and tips, ‘The Art of Making Money: The Story of a Master Stock Trader’ by Todd Mitchell is a great choice. Having written books on momentum trading and swing trading strategies before this one, Mitchell uses ‘The Art of Making Money’ as an advanced look into investment techniques like arbitrage, option strategies, and more complex ways to earn profits in the markets. It’s an excellent resource for intermediate or veteran traders who are seeking more sophisticated tactics in their trading endeavors.

Last but not least is ‘Reminiscences of a Stock Operator’ by Edwin Lefevre which offers an inside look at Wall Street trading from almost 100 years ago. By studying these lessons from history one can learn how profitable trading isn’t so much about being smarter than everyone else as it is about having discipline. This timeless classic offers great insights into market movements, risk management as well as investor psychology for those traders willing to reflect on its wisdom today.

For those looking for technical advice, Technical Analysis of the Financial Markets by John J. Murphy is an essential resource. It provides an in-depth look at various methods used in technical analysis such as chart patterns, indicators, and oscillators. This book is a must-read for any serious investor or trader who wants to keep up with market movements and use tech analysis as part of their decision-making process.

For those who want to stay ahead of the pack, Trader Vic – Methods of a Wall Street Master by Victor Sperandeo is an excellent read. In this book, Sperandeo used anecdotes and real-life examples to explain various trading strategies designed to effectively minimize risk while maximizing returns. Even though it was published in 1995, this book still applies to modern trading practices today due to its timeless advice on how to employ effective risk management techniques when trading or investing in stocks.

Another timeless work is Market Wizards – Interviews with Top Traders by Jack D. Schwager. This collection brings together interviews from some of the world’s most successful traders such as Paul Tudor Jones and Bruce Kovner. Through these interviews, readers can gain deep insight into the mindsets and strategies employed by these masters of the markets. This book will help you understand how top traders think and become better at your trade too!

If you are looking for a comprehensive guide on stock market investing, then The Neatest Little Guide to Stock Market Investing by Jason Kelly is your go-to book. In it he touches upon all aspects from basic concepts such as diversification and portfolio construction all the way through more advanced topics like understanding financial statements and managing risk exposure with options trading strategies without making it too complicated for beginners to understand.

Corporations

To be traded publicly, a business must be incorporated first. Corporations are a very interesting object. According to US law, they are like persons they have a tax number, can buy or sell, and do many other legal activities ordinary people do. And the most interesting thing about them is that they can live … forever. This means that corporations are a great way to leave your ideas, values, and understandings after you. If you run a corporation, you can act from, and hide behind its name. This is another interesting feature of corporations, they have limited liabilities. This means that the liabilities of your corporation are limited to it itself. All of its owners are not responsible for its activities. If the corporation gets sued, the worst thing that can happen to it is to shut down, all of its owners (the shareholders) are not responsible for any activities. They can only lose their investment in shares, but cannot be sued or liable because of the corporation.

Some of the greatest stock market investors and speculators

Warren Buffett (1930 – ) is perhaps the most famous investor of all time and one of the most successful stock market investors in history. Buffett has an uncanny ability to identify undervalued companies and purchase them at a fraction of their true worth. His long-term approach to investing allowed him to accumulate a huge fortune over several decades, making him one of the world’s wealthiest people today.

Peter Lynch (1944 – ) is another legendary stock market investor whose savvy trades have earned him an impressive track record. Lynch ran Fidelity’s Magellan Fund from 1977 until 1990, during which time he delivered returns of 30 percent annually and outperformed the S&P 500 by 13 percent each year on average. His record-breaking run has become legendary among stock market circles, cementing Lynch as one of the greats.

George Soros (1930 – ) is considered by some to be the greatest investor ever. Soros made his name as an aggressive currency trader in the 1970s who had no qualms with betting against entire currencies or governments if he saw an opportunity for profit. The result was immense wealth for Soros, including a shocking $1 billion dollar gain when he successfully bet against Britain leaving European Exchange Rate Mechanism in 1992 – a feat that earned him the moniker “the man who broke the Bank of England.”

Ray Dalio, is also known as one of Wall Street’s brightest stars. Dalio claims his greatest investments have hinged upon careful research into global macroeconomic trends combined with significant positions taken in securities tied to those trends (he bets heavily with derivatives). His company Bridgewater Associates is currently one of the world’s largest hedge funds with over $150 billion under its management. Throughout the decades since its founding, Dalio has claimed numerous big wins by applying what he calls ‘risk-parity principles’ – an approach that locks in gains despite market volatility or price fluctuations across various asset classes.

Jim Simons: Simons is known for creating one of the largest quantitative hedge funds Renaissance Technologies with an incredible track record throughout its 25-year history which allegedly achieved compounded returns of around 35%, significantly outperforming benchmarks by approximately 25%. Through his revolutionary use of algorithms, Simons managed to identify profitable or attractive opportunities unavailable or invisible to traditional investors, giving him an edge in markets and leading to enormous returns for his company (and himself).

Useful Resources

To learn much more amazing stuff about stock markets, stock market crashes, and our financial ecosystem as a whole, here are some pretty decent resources that you can see:

- Investopedia – a free and very rich resource where you can find loads of information about financial markets’ basics.

- About stock markets on Wikipedia – unbiased information about financial markets

The Best Stock Market Books For Beginners

- The Intelligent Investor, Benjamin Graham – this is kind of the “Stockmarket Bible” in the investing world, the notorious investor Benjamin Graham shares his principles of ‘value investing’.

- How To Make Money In Stocks, by McGraw-Hill – a very easy-to-read book about investing for rookies.

- One Up On Wallstreet, – a legend in investing, Peter Lynch, explains how to invest in the stock market as an average person.

Don’t miss trying some of our cool-looking social buttons, if you liked the article. Thanks!