What Is an Angel Investor? Difference Between Venture Capitalists and Angel Investors

What Is an Angel Investor Actually?

First of all, let’s see what a business angel (angel investor) is. This usually is a wealthy person, who is willing to finance a startup, in exchange for a part of the equity of the financed venture, or for convertible debt. It’s not unusual for business angels to be organized in groups, this way they share the risk, combine their experience and know-how, and can provide much more financing. In many cases, angel investors are retired entrepreneurs or executives in big companies. They often participate in the management of the startup and provide not only money but also know-how, business relations, and experience.

Angel investors usually invest their own funds, not like venture capitalists, who invest other people’s money. In 2010, more than 60 000 starting companies received angel financing for more than $20 billion in total. According to these numbers, in the same year, the average investment was around $33 000 (which is different from the median value shown below). investing in a starting business is very risky, that’s why business angels require a very high rate of return on their investments. They usually invest at a very early stage of a business, providing the so-called seed funding. This is why they are also called seed investors.

Difference Between Venture Capitalists and Angel Investors

What’s the difference between Angel investors and venture capitalists? While both parties invest in and help startups scale, business angels differ from venture capital firms mainly in the following manner:

Angel investors – are usually rich individuals who act in their own personal interest and invest their own (personal) money.

Venture capitalists – these people usually work for a venture capital company (they are employees), act in the interest of their company, and invest their company’s money.

Angel investors usually like to invest in businesses they know about a lot and even have some good experience in. They usually invest in a very early stage of the business, even in cases when the business doesn’t even have revenue yet. This type of investment is much more ‘personal’ and simplified. Venture capital firms tend to invest in businesses that are hot right now and usually have a more complex procedure for applying companies. They are looking for big returns which usually means quickly scalable businesses with very big potential. This type of investment is much more formal.

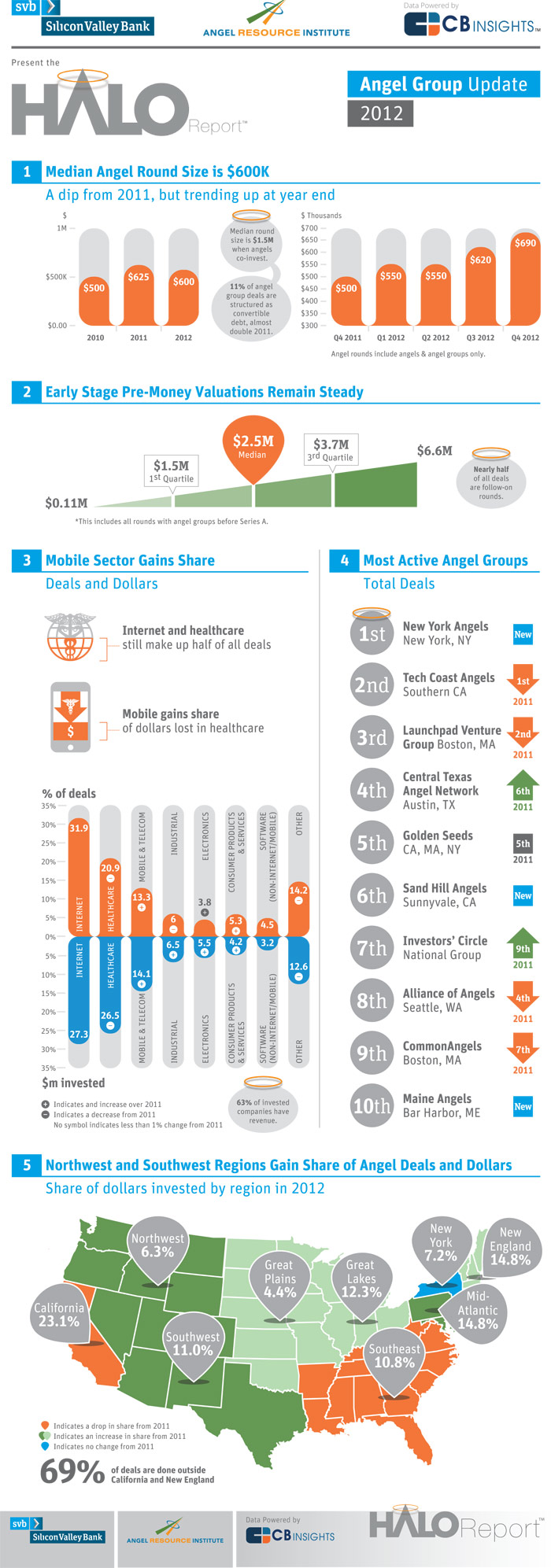

This is a cool infographic – The ‘Halo Report’ created by Silicon Valley Bank, showing what business angels invested the most in 2012:

Halo Report 2012 – Sillicon Valey Bank, source:

Halo Report 2012 – Sillicon Valey Bank, source:

https://www.svb.com/halo-report/

Are you looking for an angel investor?

If you are running a start-up or a small business, and you are searching for your ‘angel’, here are a few cool sites you can use to find it. They are probably the most popular places where people and businesses from all around the world can find angel financing:

* https://angel.co/ – one of the most popular sites, you can even find a start-up job here.

* https://gust.com/ – the site helped more than $1.8 billion to find their starting companies.

You’d better start with these two sites, but don’t forget that your angels can become your friends and family, too. If you have a rich uncle, maybe it’s time to show him your cool business idea.

Find some more cool articles about financing a business on Fundraising Ideas.

Angel investing can be an incredibly powerful tool for entrepreneurs looking to get their businesses off the ground. Angel investors, also known as seed investors, are high-net-worth individuals who invest their own money into companies they believe in and consider to be promising. In exchange for their capital, they typically receive equity in the startup.

Angel investors also add value beyond just capital — they can provide a wealth of experience, skills, and knowledge that founders may not have yet cultivated. Additionally, many angel networks often share resources for connecting startups with other potential investors or partners. This type of strategic guidance and support is invaluable for entrepreneurs on their journey from ideation to launch.

It’s important to note that angel investment is not without risk — both to the investor and the entrepreneur seeking investment. The success of any startup depends largely on its team’s ability to execute its vision, so businesses seeking angel investment should ensure they have accounting and legal teams in place before moving forward with fundraising efforts. That said, when done right, angel investing can be extremely beneficial for both sides of the equation; by taking calculated risks with companies that have an intriguing concept or clear potential for rapid growth, angel investments can prove highly lucrative for even conservative investors.

For entrepreneurs who are serious about starting a business but lack the financial resources to do so without outside investment, pursuing angel funding can be a great option — after all, what better boost than having someone believe in your vision enough to invest in it?