Real Estate Investing for Beginners: Tips to Get Started

Real Estate Investing for Beginners: Tips to Get Started

Are you thinking of investing in real estate, but not sure where to start? With the potential for high returns and passive income, it’s no wonder why many people are interested in getting into the world of real estate investing. But for those who are new to the game, it can be overwhelming to navigate the complex landscape of property values, financing options, and tax laws.

In this article, we’ll break down the basics of real estate investing and provide tips and advice for beginners looking to get started.

What is Real Estate Investing?

Real estate investing involves buying, owning, and managing properties with the goal of generating income or selling for a profit. This can include residential properties like single-family homes, apartments, or condos, as well as commercial properties like office buildings, retail spaces, or warehouses.

Benefits of Real Estate Investing

So why should you consider real estate investing? Here are just a few benefits:

- Passive Income: Renting out properties can provide a steady stream of passive income, allowing you to earn money without actively working for it.

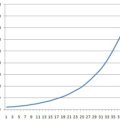

- Appreciation: Real estate values tend to appreciate over time, making it possible to sell your property for a profit.

- Tax Benefits: Real estate investing comes with tax benefits like depreciation and interest deductions, which can help reduce your taxable income.

Types of Real Estate Investments

There are several types of real estate investments that beginners should know about:

- Direct Property Investing: Buying and owning physical properties directly.

- Real Estate Investment Trusts (REITs): Investing in companies that own or finance real estate properties.

- Real Estate Crowdfunding: Investing in projects or properties through online platforms.

- Wholesaling: Finding undervalued properties and selling them to investors at a profit.

Getting Started

So how do you get started with real estate investing? Here are some steps to follow:

- Educate Yourself: Start by learning about the basics of real estate investing, including property types, financing options, and tax laws.

- Set Your Goals: Determine what you want to achieve through real estate investing, whether it’s generating passive income or building wealth.

- Build Your Team: Surround yourself with experienced professionals like real estate agents, lenders, and attorneys who can guide you through the process.

- Start Small: Begin with a small investment, such as a fix-and-flip project or a rental property in a low-risk area.

Tips for Beginners

Here are some additional tips to keep in mind:

- Don’t Lend Money: Unless you have experience with lending money to others, it’s best to avoid being a lender in real estate investing.

- Be Patient: Real estate investing is a long-term game; be prepared to hold onto your properties for at least 5-10 years.

- Research, Research, Research: Always research the property market and local regulations before making an investment decision.

- Get Pre-Approved: Get pre-approved for financing before starting your real estate investing journey.

Financing Options

When it comes to financing a real estate investment, there are several options available:

- Cash: Investing cash upfront is the most straightforward way to finance a property.

- Mortgages: Commercial mortgages or private money loans can provide funding for larger investments.

- Hard Money Lenders: Hard money lenders offer short-term, high-interest financing for fix-and-flip projects or other short-term investments.

Tax Implications

Real estate investing comes with tax implications that beginners should be aware of:

- Depreciation: Claiming depreciation on your properties can help reduce your taxable income.

- Interest Deductions: Interest payments on loans used to finance a property can also be deducted as expenses.

- Capital Gains Tax: When you sell a property, you’ll need to pay capital gains tax on the profit.

Conclusion

Real estate investing can be a rewarding and lucrative way to build wealth, but it’s not for everyone. By following these tips and doing your research, beginners can set themselves up for success in this exciting world of investment opportunities.

Remember, real estate investing is a long-term game that requires patience, dedication, and hard work. Start by educating yourself, setting clear goals, and building a strong team around you. With the right mindset and guidance, you’ll be well on your way to achieving financial freedom through real estate investing.