Category: Fundraising Ideas

Fundraising Ideas. Some suggestion for financing a start up venture.

Some tips when finding financing for your small business… Funding is one of the most crucial things for a start-up. When you are a starting entrepreneur, money is usually scarce and at the same time, it’s so needed for growing the business. But does a start-up really need to seek cash in all circumstances? Actually, funding is not always good and there are bad moments to do that. Sometimes it can even have a negative effect on growth and performance, this is why it’s not always good. Another important question is ‘What to seek funds for?’. There are so many...

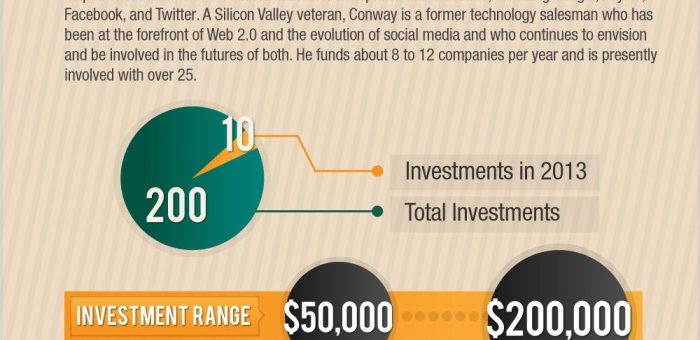

What is an Angel Investor? An angel investor is an individual investor who provides capital for a business in exchange for an ownership stake in the company. Angel investors typically invest their own capital as opposed to managing funds and often look for entrepreneurial businesses in need of seed money or early–stage capital. These investors generally look for businesses with high growth potential and are typically motivated by the potential for long–term gains and social impact. Angel investing is riskier than traditional investing because the companies have yet to prove that they have a successful product or service in the market....

A startup accelerator also referred to as a seed accelerator, is a form of a business incubator that is chasing profit by usually acquiring a part of a business and then helping the latter to grow. Its main purpose is to help high-potential business ideas with mentoring, office space, know-how, education, and of course seed capital in exchange for a piece of the equity of the new business. The support is for a certain period of time ranging from 3 to 18 months and it is usually provided at the very beginning of a start-up. Business incubators are different from...

Money is the lifeblood of any business. It is the fuel that any company needs at any stage of its existence. No matter how big it is, no matter how many workers are employed, any venture needs financing to stay operational. In this article, we will go through the different stages of financing and see the different ways businesses obtain their money in their life cycle. Funding Stages / Business Financing Stages Seed Funding Stage – this is the very first stage of financing, in which the business may not even be founded yet. This is the money used for...

Seed capital also referred to as seed funding is a commonly used term in the business world. But what does it mean and how exactly is it used? Well, in this article I will try to explain its basics. So, seed funding is a form of financing in which the owner of a business receives money in exchange for a part of the equity of his/her company. It is called ‘seed’ because it happens at the very beginning of the business before even the latter generates any money (before it is started). This makes seed funding a very risky investment...

Arranging the needed funds for your startup is a crucial factor for its successful launch. Even though money is not the most important thing, it’s 100% needed when launching a new venture. If you are a starting entrepreneur, you most probably have been thinking about how exactly to find the cash for your starting business. Well, the consulting company Startups.co has created this wonderful infographic, showing some interesting statistics about how startups get mainly financed. Here you can not only see the main options about how to get funding for a startup but also some intriguing statistics about the ways...

I had the chance to catch up with Sandip Sekhon, the founder of the crowdfunding website GoGetFunding. A website that is increasingly growing in popularity and was recently mentioned by Forbes as one of the top 6 crowdfunding sites. Here, he talks about how it all began: As an online entrepreneur, I’m always looking at how exciting businesses can be made even better. And back in 2010 when I conceived the idea for GoGetFunding, crowdfunding was still pretty new and was just starting to take off. Kickstarter and IndieGoGo were leading the way and although they were and still are...

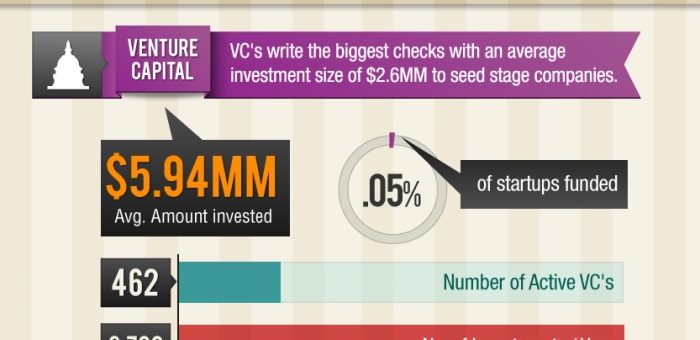

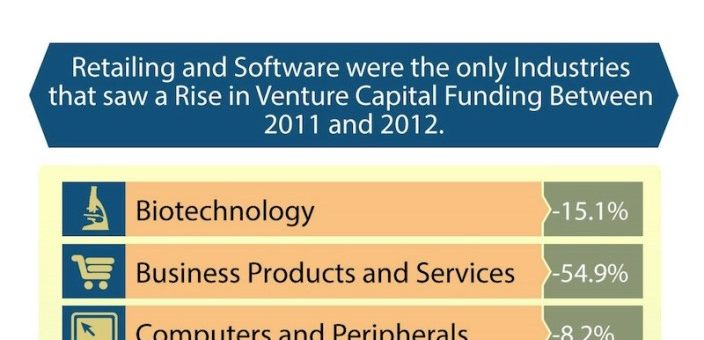

Venture capital funding is one cool and accessible way of satisfying the hunger for cash of a dynamically growing startup. The company StartUps.co, which main activity is providing help to starting entrepreneurs throughout the fundraising stage, has created this beautiful infographic below, where you can see some interesting statistics about venture capital financing in the US. This information can be of great help because you can get a feel about the basics of this kind of funding. More than $100 billion was the invested money by venture capital companies during the Dot Com Boom in 1999. On average, this number...

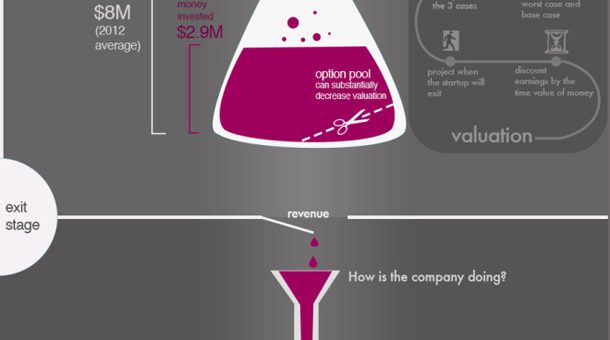

One of the crucial things for the survival of a startup is finding the money for its growth. Fundraising is extremely hard for starting companies, because of the huge risk involved and the lack of collateral for backing up the funds. But it is easy to avoid the most common mistakes an entrepreneur makes when searching for funds. The consulting company Founder Institute made research on this matter and they created this beautiful infographic below. There you can see the most common mistakes you could make while searching for cash to start your business. Attracting the attention of those worth...

Most of the biggest online companies that exist today – Google, Yahoo, Facebook, eBay, you name it…, probably wouldn’t be here, if they didn’t receive venture capital or angel financing at their beginning. But putting money into a business is the easiest part, accurately evaluating its potential is what makes the difference between a highly successful and a bad investment. Investing in a multi-billion company at its start is like hitting the jackpot. All of the early investors in Google have made millions and even billions (like Andreas von Bechtolsheim for instance). But spotting such a gold mine is not...